Regulation D 506(c) Offering • Accredited Investors Only

MDCRE Triple Net Lease Fund

Medical Dental Commercial Real Estate

A rare opportunity to invest in recession-resistant medical real estate with long-term triple net leases and proven healthcare tenants.

For Accredited Investors

Recession-Resistant Medical Real Estate

Proven Sponsor with $237M+ Track Record

8% Cash-on-Cash, 13-16% Target IRR

Key Investment Highlights

We are excited to present our current investment opportunity: a portfolio of medical real estate properties consisting of healthcare tenants with long-term NNN leases.

Preferred Returns

7%

Estimated distributions paid quarterly, 1st quarter after closing

Net Target Returns

13-16% IRR

Base case with upside potential to 16-25% IRR

Asset Class

Medical Real Estate

Low underlying risk and volatility due to medical tenants with 10+ year NNN leases

Hold Period

5-year

Hold period with potential for 3 years upside

Cash on Cash

8%

70-80% profits split to LP (Limited Partners)

Tax Efficient

$50k

Estimated to receive $50k in tax deductions in year 1 on a $100k investment

Invest With Impact

We donate a portion of our General Partner profits to our Redemption Foundation (Donor-Advised-Fund), which supports a variety of non-profit organizations dedicated to suicide prevention.

A portion of GP profits support organizations like Hayden's Corner

WATCH THE REPLAY

Exclusive Investor Webinar

Join us for an exclusive deep-dive into the MDCRE Triple Net Lease Fund. Meet the team, review the properties, and get your questions answered live.

Why This Opportunity Matters

Medical real estate is an overlooked cornerstone of income-focused portfolios. As the U.S. population ages and demand for outpatient care accelerates, essential facilities like surgical centers, specialty clinics, and infusion centers offer stable cash flow, tax advantages, and durable tenant demand.

This fund targets long-term triple-net leases with healthcare operators, combining predictable income with downside protection and strong growth potential.

Why Medical Real Estate

Strong and Reliable Healthcare Tenants

High quality income stream due to consistent demand of essential services (recession-resistant) industry.

Long-Term (Net) Leases

Tenant turnover risk mitigated via 10+ year leases provide predictable cash flow.

Cap Rate Differential

Capitalize on the difference between the purchase cap rate and the market cap rate.

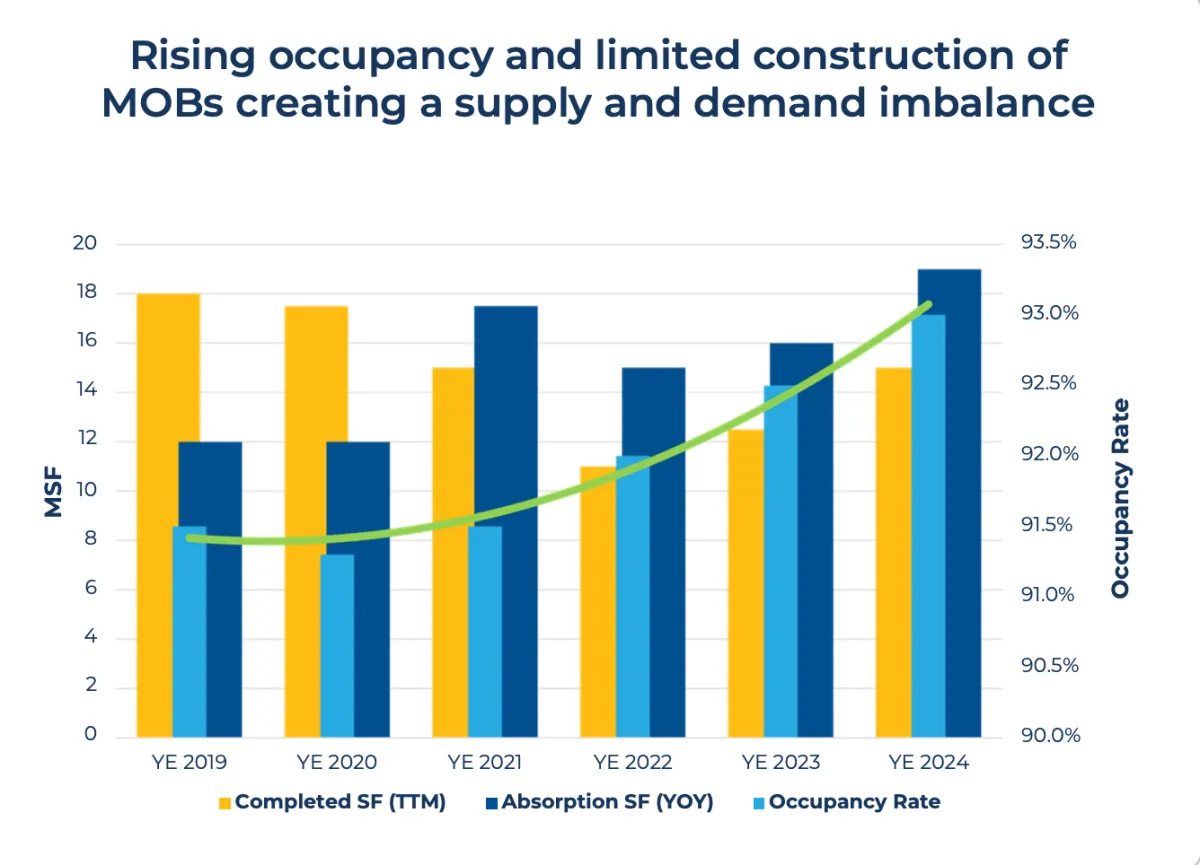

Supply and Demand Imbalance

Rising occupancy and limited construction of MOBs creating a supply and demand imbalance.

How Returns Are Generated

01

Acquisition & Cash Flow

Acquire below-replacement-cost properties with immediate day-one income.

02

Compounding & Value Creation

Rent escalations, tenant expansions, and debt paydown increase NOI.

03

Exit & Return of Capital

Portfolio sale to healthcare REITs or Individual asset sales capture appreciation

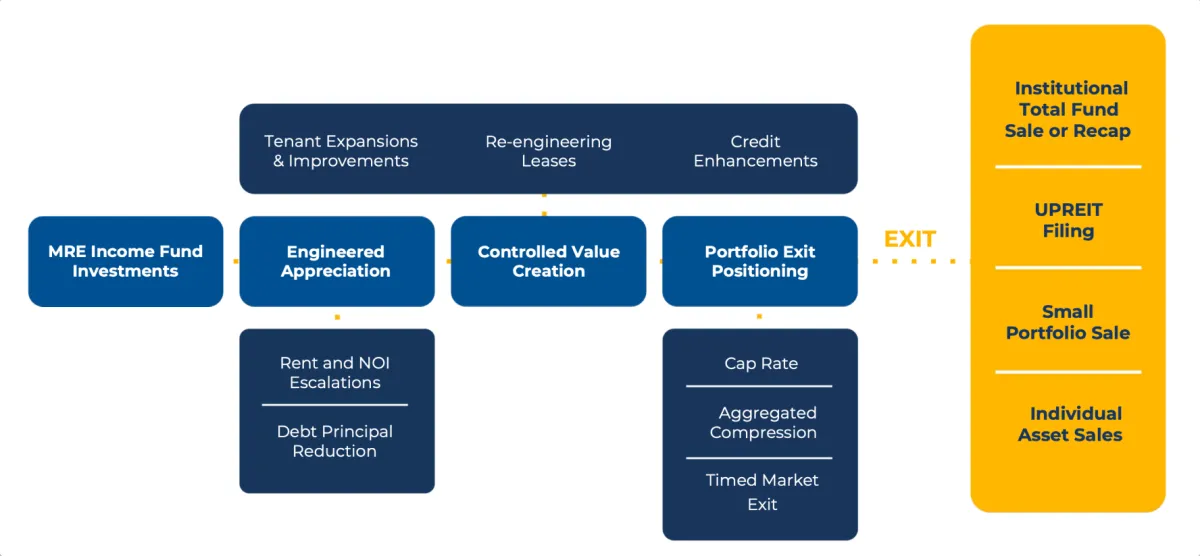

Projected Investment Lifecycle

Risk-adjusted capital growth through strategic acquisition, active management, and multiple profitable exit strategies.

1

YEARS: 0–2

Roll up & Acquisition

$10M+ of equity invested

$30M+ AUM of MRE

Immediate distributions

2

YEARS: 1-3

Compounding & Management

Escalators = more NOI

Debt principal pay-down

Yield-enhancing opportunities

3

YEARS: 3-5

Harvest & Disposition

Exit of properties

Individual or portfolio sales

Flexibility on market timing

Exit Strategies

Multiple Profitable Exits

Initial Portfolio Acquisitions

Multi-Specialty Holdings Dental Portfolio

3 properties (FL, TN, AZ)

15-year absolute NNN leases

$1.6M instant equity crosted

IRR

16%

EM

1.9x

CoC

9.5%

McDowell Ambulatory Surgical Center - Phoenix, AZ

32,806 SF surgical center

30-year absolute NNN lease

$5M equity created

IRR

25%

EM

2.6x

CoC

9.6%

About the Sponsor

Redeem Investments focuses exclusively on essential medical real estate, combining healthcare industry insight with institutional real estate expertise.

Founded in 2017, the firm's leadership team brings decades of experience across multifamily, hospitality, and medical assets, with a track record of successful acquisitions and exits nationwide.

A portion of GP profits supports suicide prevention through the Redemption Foundation.

Christian Catron

Redeem Investments

About the Fund Manager

Jack Nguyen

TheBluePrintRx

Real Estate Portfolio

Converted 1,221 units from hotel to multifamily properties across Washington,South Carolinas, Houston & Dallas Texas.

Capital Raising

Lead capital sponsor for 591-unit conversion project, raising $18.7 million. Funded in 2.5 months.

Diverse Investments

Holds limited partner interests in multiple syndications with expertise in stock and options trading. Recent closed on "Onyx on Park 71" San Diego Syndication Multi-family housing. Most recent closes: 156 Sq Acre parcel of land "Buckeye" Arizona, Tonopah 2040 Sq Acres of Land, Golden Hill 45 MF (San Diego), Balterra & Camelback Creek Land on Arizona Oct 3rd, 202

Ready to Invest?

If you're interested in learning more about this investment opportunity, please request the Confidential Private Placement Memorandum (PPM).

First Close Deadline

November 14, 2025

Reg D, Rule 506c Offering

This offering is available only to accredited investors as defined by the SEC. This includes individuals with $1M net worth (excluding primary residence) or $200k/$300k income for individual/joint, or entities with $5M total assets.

Submit Your Interest

Contact Information

Investment Interest

Additional Notes

Important Disclaimer

This is a preliminary presentation that does not constitute an offer to sell nor the solicitation of an offer to buy any security. Such an offer may only be made through the Fund's Confidential Private Placement Memorandum and related exhibits and enclosures (the PPM), which should be carefully reviewed. The information herein is qualified in its entirety by reference to the information, terms, risks and conditions presented in the PPM and the Fund's investment strategy.

This summary is for informational purposes only and is not an offer to provide any investment advisory services. The contents are based on information from sources believed to be reliable, but accuracy and completeness cannot be guaranteed.

Past performance and recommendations of any principal are not a guarantee of future success. This summary is being furnished on a confidential basis to a limited number of prospective investors who are "accredited investors" or "qualified clients" or "qualified purchasers" and may not be used or reproduced for any purpose. This is a Regulation D 506(c) Offering.

Projected performance is not a guarantee of future results. All investments involve risk, including the loss of principal. Please see the PPM for complete risk disclosures.

Quick Links

Contact

© 2025 TheBluePrintRx. All rights reserved.

Regulation D 506(c) Offering • Accredited Investors Only